How to Open Account

Who can open an account?

- 1.One person can have only one bank account.

- 2.The following person cannot open a bank account:

- (a)a person under fifteen (15) years old; or

- (b)a non-resident person under the Foreign Exchange and Foreign Trade Act of Japan

- (Example)

- (i)a non-Japanese person not working at an office located in Japan;

- (ii)a non-Japanese person who has stayed in Japan for less than six (6) months

(e.g., a foreign student who has stayed in Japan for less than six (6) months) - (iii)a foreign diplomat or consular officer

- 3.For the application of opening the bank account, you are required to submit two identity verification documents designated by us. In case that you do not have Japanese nationality, you always need to submit your residence card or special permanent resident certificate as an identity verification document. Another type of identity verification documents that can be used are as follows:

- (i)driver’s license;

- (ii)public health insurance card;

- (iii)basic resident registration card;

- (iv)individual number card (my number card); or

- (v)resident certificate.

- *All documents must be issued in Japan. No foreign documents are acceptable.

- *Passports issued by countries other than Japan are not acceptable.

Notes

- Our services, including customer support, are available only in Japanese.

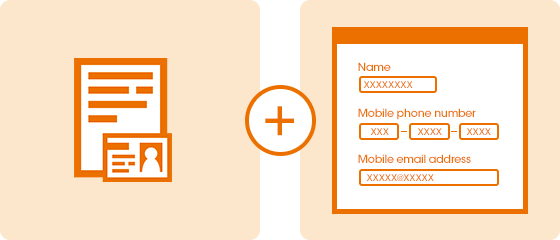

Step1:New Application

You can apply with your PC or smartphone.

Please prepare your identity verification documents (residence card or special permanent resident certificate, and another type of identity document) and enter the details of the required information.

For the application, you need to have a mobile phone number in Japan (i.e., country code is +81) and mobile email address that are available in Japan.

Notes

- Please enter the information accurately as described in the identity verification documents (especially, residence card or special permanent resident certificate).

- If you have a middle name, please enter the middle name in the column “First Name” followed by the first name.

- If there is any discrepancy between the content of the identity verification documents and the application information entered by you, you cannot open the bank account.

Step2:Identification

You can submit the identity verification documents through our website.

Notes

- We will handle the identity verification documents submitted by you with proper care for the protection of your personal information. “Sensitive information” on the identity verification document (such as the place of domicile, medical history, etc.) is not required, so please black out the relevant part before submitting it to us.

- Each identity verification document must be effective and within the validity period on its arrival to us.

- When you make a copy of any identity verification document for submission and if any amendment or modification has been officially made on the verification document, please make sure that the copy clearly shows an official seal which admits such amendment or modification on the document.

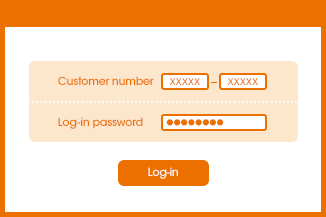

Step3:Initial Setting (Log-in)

Please complete the initial setting, including a registration of log-in password and application usage, after receiving your cash card and initial setting guidebook.

After the completion of the initial setting, you can use our online banking services.

In case that you submit the identity verification documents through our website, we will ship the cash card about five (5) business days after your application.

The cash card will be sent by simple registered mail (Kan-i Kakitome).

Notes

- We will not open your bank account if the cash card or other material (if any) sent to you is not received by you and returned to us. In addition, in the event that we cannot communicate with you for a considerable period of time, we may suspend all or part of the banking services or close your bank account without notifying you.

Customer Awareness

The following are important information and caution regarding the safety use of our banking services. Transactions such as the sale of your bank account or other money laundering activities described herein are criminal. Please refrain from doing such transactions.

Notes on managing ATM cards and mobile phones

Please place strict controls on your cash card, mobile phone used for mobile phone banking, and smartphone used for internet banking.

Do not carry your cash card with memo describing your PIN code or password.

The back side of the cash card contains important information for your banking transaction, so be sure not to be known such information to anyone else.

If any of your cash card, mobile phone or smartphone is lost or stolen, please immediately call au Jibun Bank Customer Center (24 hours a day, 7 days a week).

During the period when the use of your cash card is suspended, the transactions using the information on the back of the cash card is also suspended.

Money Laundering

Buying, Selling, or Handing over a Savings Account to a Third Party

Opening, or selling, transferring or lending, a bank account by pretending to be someone else is prohibited by the applicable law and au Jibun Bank's terms and conditions. It is also a crime to sell your bank account to another person when you permanently leave Japan.

In order to prevent such crimes, we will regularly conduct your identity verification. If any criminal activity is found with respect to the bank account, we will immediately notify the relevant authorities and take appropriate measures to suspend or close the relevant account.

In addition, we will, in the future, refuse the application for opening a bank account from a person who committed such criminal activities.

You should be careful not to accept any solicitation for sale or purchase of bank accounts so that you are not involved in criminal activities or other troubles.

Other financial crimes

Underground Bank and Illegal Loan, etc.

It is a crime to conduct any banking business without proper licenses, or any funds transfer service without registrations under the applicable law. You must not use such business as a customer or be involved in such business in any manner.

Involvement in Money Laundering and Terrorist Financing

If we determine, at our discretion, that your transaction is, or is suspected to be, an action relating to money laundering (e.g., depositing or remittance of money with concealing the fact that it is criminal proceed) or terrorist financing, we may suspend or refuse the transaction. In addition, please do not be involved in these actions as they are criminal.

Counterfeit Cash Card

You must not make or use any counterfeit cash cards.

When you leave Japan permanently

Closing your account

Only a person who is a resident in Japan can have the bank account of au Jibun Bank.

If you are not a resident in Japan, you cannot withdraw or transfer funds from your bank account.

Please be advised that when a non-Japanese person leaves Japan and becomes a non-resident of Japan, such person is required to close the bank account before leaving Japan.

For more details, please call 0120-926-111 (Hours: 9:00am to 5:00pm, excluding December 31 through January 3). Customer support is available only in Japanese.

Frequently Asked Questions

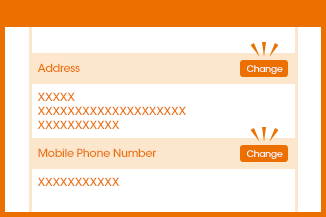

How do I change my address/phone number?

Please update via au Jibun Bank’s internet banking.

After log-in, please follow the instruction below:

- 1)Select [各種手続き・照会];

- 2)Select [登録情報照会・変更];

- 3)-a(Change of Address)

Select [変更する] in the column [ご住所]

Enter the new address and zip code - 3)-b(Change of Mobile Phone Number)

Select [変更する] in the column [携帯電話番号]

Enter the new mobile phone number

I have lost my ATM Card. What should I do?

You need to suspend your bank account for your lost cash card.

Please call 0120-926-111 (Hours: 9:00am to 5:00pm, excluding December 31 through January 3). Customer support is available only in Japanese.

We will issue your new cash card. The new cash card will be delivered to your registered address within approximately one (1) week.

Can I transfer foreign currency deposits overseas?

You cannot transfer money overseas through our banking service.

Can I pay Utility bills from my account?

You cannot pay your utility bills through our banking service.

How can I arrange to have my salary deposited into my account?

Please let your employer know information on your bank account, including the account number, type of account, account holder’s name, branch name, branch code and bank code.

The bank code is 0039.

The type of account is savings account (Futsu Yokin).

The branch code, branch name and account number are described on your cash card.

The account name is registered in both Roman and Katakana. Either option is acceptable.

Be sure to notify your employer of the correct account name registered at au Jibun Bank. Please note that if the account name quoted for a remittance differs in any way from your registered account name, the remittance will not be deposited into your account.

What transactions are available on Internet banking?

On our internet banking service, you can make banking transactions, including setting of fixed term deposit, foreign currency transactions (JPY⇔foreign currency), balance inquiry, domestic money transfer, and change of usage limit for ATM and money transfer, etc.

You can use our service for 24 hours a day, 365 days a year; provided, however, that the service may not be available due to system maintenance, as the case may be.

Can I use this service from abroad when I return home temporarily?

Please note that you are asked to refrain from using our internet banking service outside Japan even if you temporarily leave Japan for return to your country or travel. We do not guarantee the proper operation for the use of our internet banking service outside Japan. Please also note that if you use our internet banking service outside Japan, you must use it at your own risk and responsibility and be liable for any violation of the applicable laws and regulations. In the event that au Jibun Bank or a third party incurs any damage due to your use outside Japan, we may claim compensation for damages from you.

The account of au Jibun Bank is available only for a resident in Japan.

A non-resident in Japan cannot withdraw or transfer funds from its account.

Please note that a non-Japanese who plans to leave Japan by changing its address from Japan to overseas, rather than temporary returning or traveling abroad, need to close its bank account before leaving Japan.

My validation period has been changed.

What procedures should be followed?

In case that the validation period of your residence card provided to us is changed due to an extension or shortening, the following procedures are required:

- 1)Call 0120-659-872 (Hours: 9:00am to 5:00pm, excluding Saturdays, Sundays, public holidays, and December 31 through January 3); and

- 2)Please submit your updated residence card describing the renewed validation period in a manner designated by us.